Banking customers have grown more discerning. In 2025, nearly three-quarters maintain a relationship with at least one competing bank, according to Accenture. This signals waning loyalty and a growing openness to switch. What’s more, nearly half of banking customers aren’t sure they’ll stay with their current financial institution in the next year.

Adding to this challenge is something already keeping bank marketers up at night, which is the great wealth transfer. An estimated $84 trillion is set to change hands over the next 20 years. No pressure, right?

And that means if you’re creating a bank marketing strategy, it has to be strong.

The good news for marketers is that you also have tools and strategies that can help you connect the dots between your bank’s business goals, your marketing strategy, and your customers’ needs. These tools can support customers with learning more about what you offer and, most importantly, help you retain them.

Aligning Strategy with What Customers Actually Want

Banking customers have less and less tolerance for financial institutions that don’t really know them. Those personalized experiences that once felt like a “wow” are now totally expected. One survey found that nearly half of banking customers would consider switching banks if a new one offered more personalized digital experiences.

One of the best ways to deliver these types of experiences is through tapping into your data and keeping current on your audience research. By doing both, you can more easily align your bank’s business goals with your marketing goals and customers’ needs.

For example, let’s say one of your bank’s business goals this year is to grow deposits by 20%. You could start by digging into your customer research to find the intersections between audience needs and your products. Then you can build your marketing strategy around targeting those needs.

But let’s back up a minute. What if you don’t have audience research, or you do, but it’s really old? That’s okay – you can still move forward. Here are a few ways to check the pulse of your customers:

- Talk with your frontline teams. Ask bank staff, relationship managers, and customer service reps what customers are asking about the most in the area of deposits. What do they need right now? What phrasing are they using to describe their problems?

- Pull recent customer data. Review trends in account openings, product usage, and digital engagement metrics.

- Send a short pulse survey. Email existing customers to ask targeted questions about their current deposit needs.

After gathering your research, you might learn that many of your customers want higher-yield savings options but don’t really understand the differences between your products. If so, you could focus your bank marketing strategy on education that clarifies product value and helps customers better understand their options.

Then, if you have other business goals to align with your marketing strategy, you can use a similar process to gather insights and make sure your business goals, your marketing strategy, and your audience’s needs are all in sync.

Factoring in Journey-Based Marketing

At this point, you’ve tied your bank’s business goals to your marketing strategy and sorted through the data to get clear on customer needs. Now it’s time to think more about customer journeys and integrate personalization.

The people you serve are on many different paths. For example, maybe a customer is renting but would really like to own a home. If so, they would likely want to hear about your first-time homebuyer programs.

Or a customer with young children might want to learn more about how to save for college. The point is that you can use the data you have to understand where customers are in their journey so you can join them with helpful resources and product recommendations.

But let’s talk a bit more about the data. How do you find it?

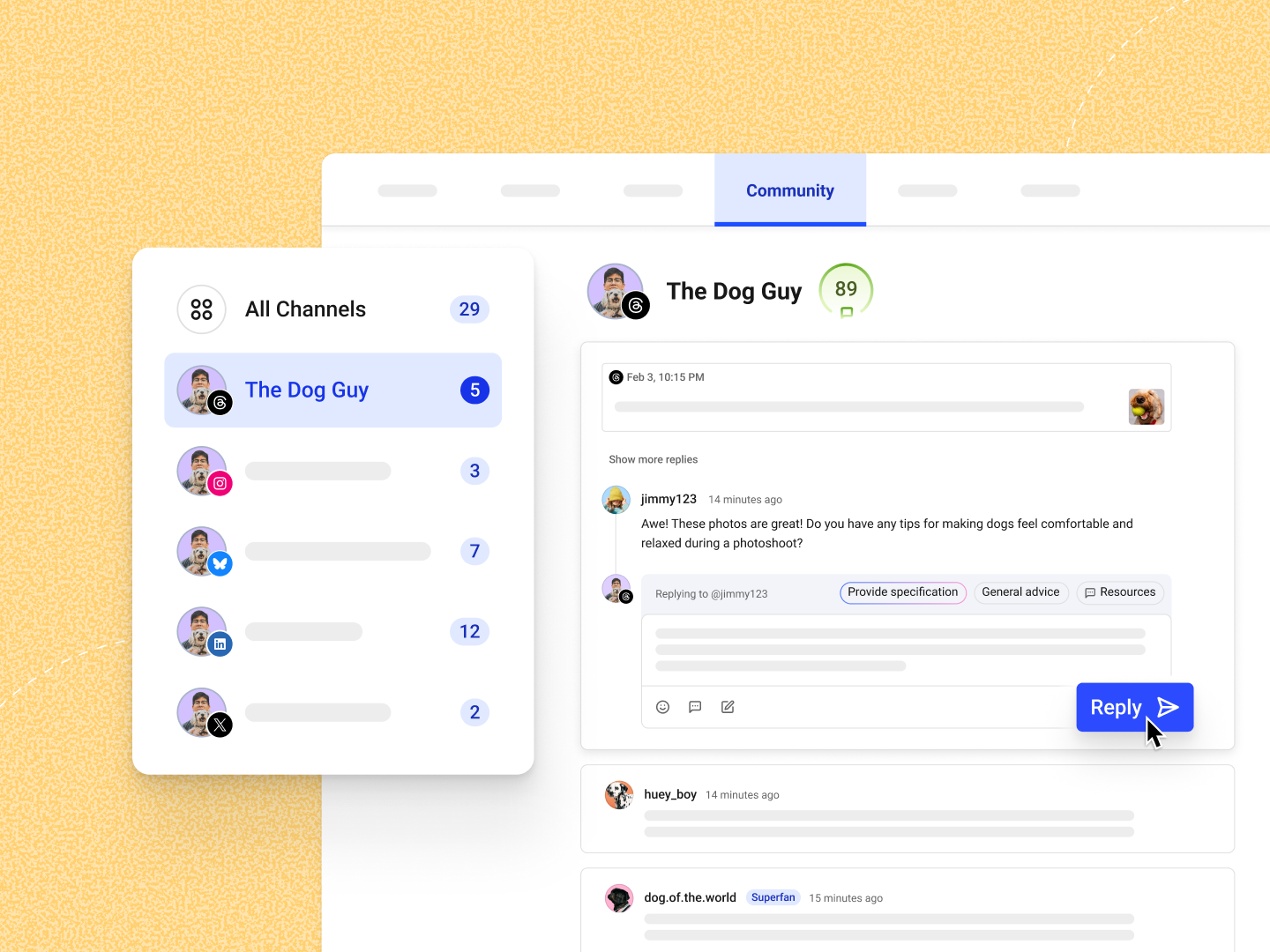

We’ve found one of the easiest ways to capture this type of data is through a marketing automation tool. It can help connect your data, channels, and timing so that customers receive the right information at the right point along their journey.

You could set up the tool to automatically deliver messages based on a customer’s specific behavior. For example, you could send educational content about mortgages when someone explores home loan pages or offer savings insights after a specific type of new account is opened. Having these insights means that you’re no longer guessing who might be interested in specific products; you’re letting the behavior lead the way.

Expanding Your Strategy into the Best Channels

We can’t discuss your marketing strategy without talking about the channels where your customers hang out. Let’s go back to that audience research we discussed earlier. As you’re checking that pulse, it’s a great time to see where your audience is spending time.

As you collect audience research, here are a few ideas for learning more about channels:

- Ask branch staff or relationship managers, “When customers mention hearing about a deposit product or promotion, where do they say they saw it: social media, email, a web search, or somewhere else?”

- When you pull recent customer data, check analytics to answer the following: “Which channels are driving the most traffic or inquiries for deposit products: email campaigns, social ads, or organic search?”

- If you send a short pulse survey, add a customer question such as “Where do you usually hear about our new products or offers: social media, email, our website, or in your local branch?”

A few targeted questions can help you figure out where your audience spends time so you can focus on the best ways to reach them when you’re designing your bank marketing strategy. Also, building consistent touchpoints across the channels people prefer helps you create the familiarity and trust needed to meet your marketing goals.

Tweaking Your Bank Marketing Strategy for Results

Marketing is a bit of a science experiment, isn’t it? As you create your strategy and put it into action, it’s important to leave room for a few pivots. Sure, it would be nice if everything worked perfectly the first time, and sometimes it does. But more often, you’ll need to make adjustments along the way.

That new email nurture sequence you just launched? Maybe the open rates are a little low, so you A/B test different subject lines to get more people to open it, and conversions on your CTA go up significantly. Or perhaps your open rate is great but click-throughs are low. So you tweak the CTA to make sure it aligns with customer pain points and delivers better results.

Aligning your bank marketing strategy with your business goals and grounding it in audience research helps you deliver the personalization that keeps your customers happy and grows business through the great wealth transfer.

Do you feel like you could use a little more guidance getting started?

Our detailed guide breaks down how marketing automation can support a successful bank marketing strategy. It will help you connect with your customers, deliver real value, and build deeper relationships that earn more of their business.